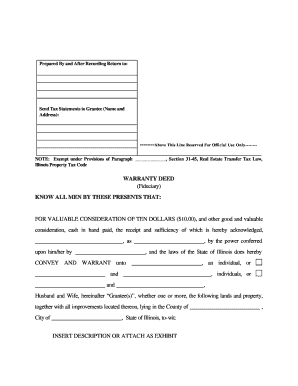

The buyer has the right of occupancy and, in states like Minnesota, the right to claim a homestead property tax exemption. The buyer immediately takes possession of the property, often paying little or nothing down, while the seller retains the legal title to the property until the contract is fulfilled. In a contract for deed sale, the buyer agrees to pay the purchase price of the property in monthly installments. Facts and featuresĪ contract for deed, also known as a "bond for deed," "land contract," or "installment land contract," is a transaction in which the seller finances the sale of his or her own property.

The following article presents basic facts and features of the contract for deed and offers suggestions for minimizing the risks associated with this mortgage substitute. In addition, these contracts may contain provisions that leave room for abuse and can pose risks and uncertainties for both the buyer and seller. Nonetheless, this alternative financing mechanism lacks many of the protections afforded borrowers who have traditional mortgages. Indeed, public and nonprofit housing advocacy organizations have used the contract for deed as a tool to help low- and moderate-income households attain homeownership. The arrangement can benefit buyers and sellers by extending credit to homebuyers who would not otherwise qualify for a loan. In a contract for deed, the purchase of property is financed by the seller rather than a third-party lender such as a commercial bank or credit union.

One such alternative is the contract for deed. Some financial counselors predict that borrowers with limited options may turn to alternative means of purchasing a home. Because of recent credit tightening, some homebuyers may be less likely to qualify for mortgages than they were just a few years ago.

0 kommentar(er)

0 kommentar(er)